Could you use an extra $1,000? There are several easy savings plans that are available that can help you and your family put aside some extra cash. The money can be used for a variety of things such as emergencies, car maintenance, vacation, home decor, clothing, etc. Below are 3 savings plans that are easy to follow, yet effective.

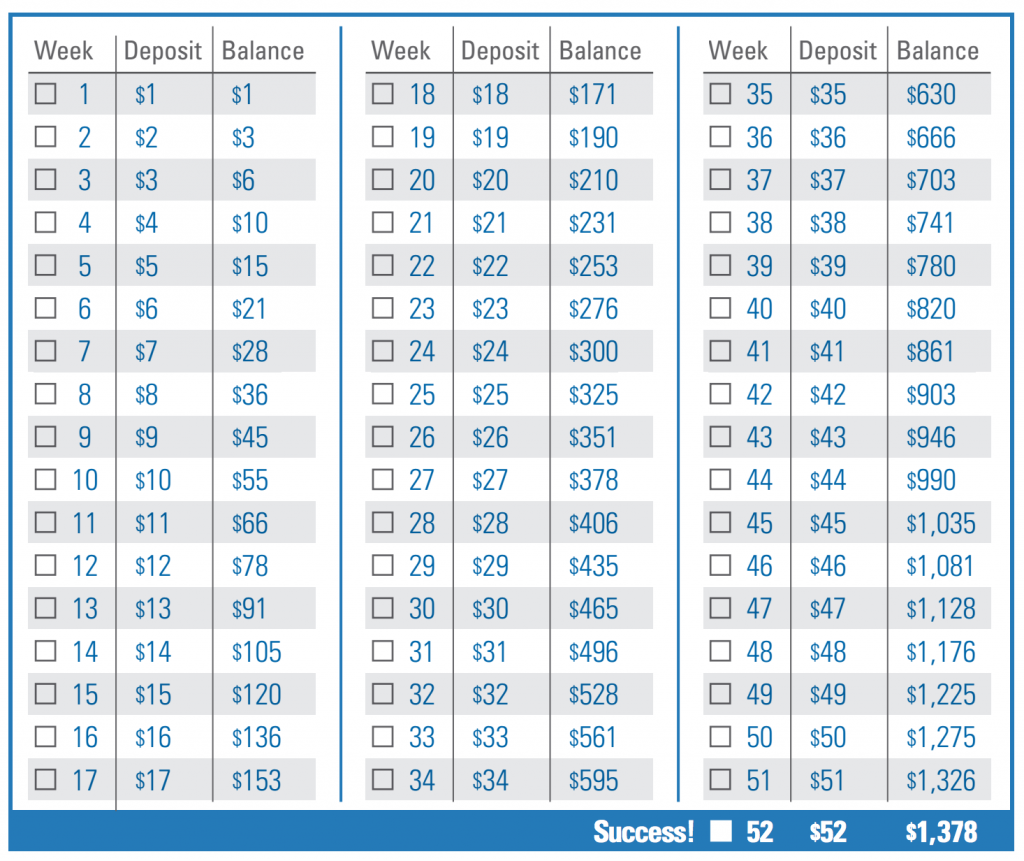

The 1st Savings Plan – The 52-Week Challenge

This plan is great because the participant puts aside a small amount each week until he or she has completed 52 weeks. The money set aside corresponds directly with the number of weeks for example:

Week 1 – Save $1

Week 2 – Save $2

Until week 52 – The person will save $52, and at the end of the year the participant would have saved $1,326.

You can view the full plan here: 52-Week Challenge

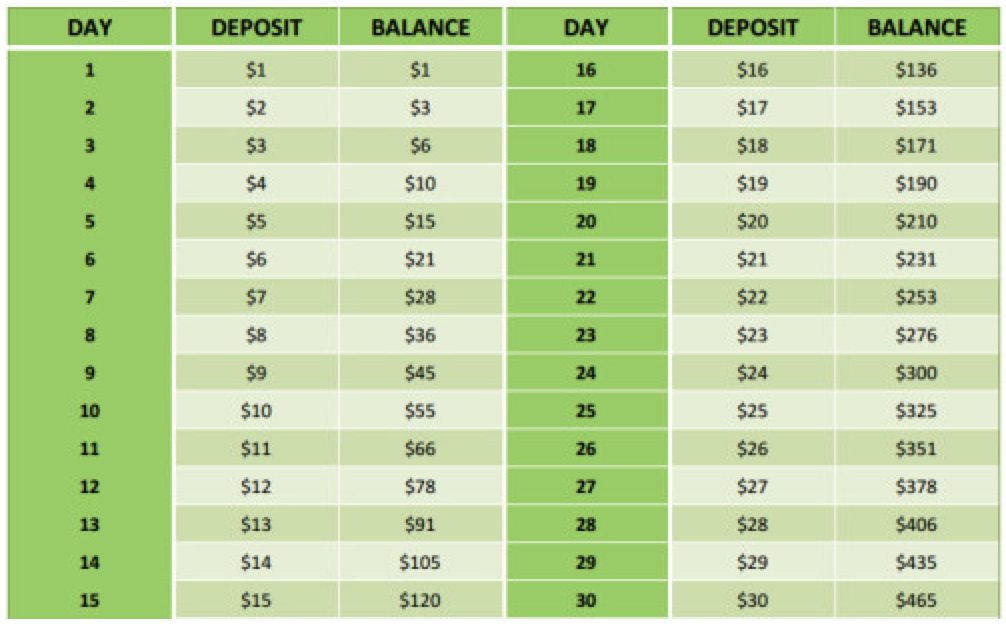

2nd Savings Plan – 30 Day Challenge

This plan is great if you want to see saving accumulate very quickly.

Participants who choose to follow this challenge will save $465 in only 30 days.

The key to successfully completing this challenge relies on the participant saving money every day instead of saving each week.

You can view the full plan here: 30 Day Challenge

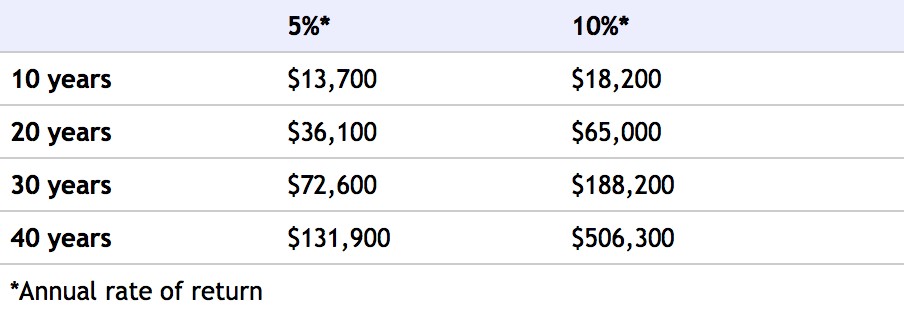

3rd Savings Plan – Save $20 a week

This plan is a long-term plan that helps the participant accumulate money over time. The goal is to put away just $20 each week for 10, 20, or even 40 years.

Those who save $20 a week for 10 years will save a minimum of $10,400. But if you place your savings in a bank account that yields interests, the participant will save even more.

Although interests rates are at an all-time low, click here to view a calculator to help you estimate your long-term savings.

The challenge you choose will also depend on what you’re trying to save for. But by all means save for a rainy day.

Reader Response:

Which challenge do you like best? Do you know of a different money-saving challenge that you really like? If so please share the name and link of the challenge.