Earn free money by signing up for bank incentives.

In order to encourage new customers, banks are giving away free money (it will be taxed) to you and your friends if you decide to bank with them. If you read the fine print, you can make some free cash this season. In the past, I have signed up for several of these free bank offers with no problem, and earned some great perks too. I prefer the accounts that don’t require a monthly direct deposit, but if it’s easy to set up a direct deposit transfer, then go ahead and get the free cash, just keep in mind the requirements of each promotion.

Online banking is great because if you already have a checking account you don’t have to physically go to a bank to open the account, you can do it all from your computer when you transfer the minimum deposit amounts.

3 Tips to making good on each offer

- Pay attention to recommended Deposit dates and minimums

- Avoid unnecessary fees when you comply with minimum balance requirements

- Record the payout date. (Keep a print out the exact promotion to make sure that you comply with the requirements)

$50 Bank Incentives

$50 Bank Incentives

For instance, Capital One 360 savings account is giving $50 for people willing to ope a new account. I like their services because they offer easy online banking and an easy to use app, so you can always keep track of your money. You can even deposit checks with your mobile device, it’s amazing how much you can do with a little app. In order for this promotion to work, the account must be opened with at least $250.

To take advantage of this limited time offer. Sign Up Here for a Capital One 360 account.

360 Checking® account: Bonuses are only paid for accounts that are opened and a total of 3 Debit Card purchases or Person2Person Payments (or any combo of the two) are made within 45 days of account opening.

The $50 bonus is available only for new accounts with a new Customer as primary owner. Payout on day 50.

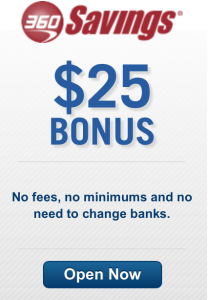

$25 Bank Incentives

360 Savings® account: Bonuses are only paid for accounts that are opened with an initial deposit of at least $250. Initial deposit does not include bonus. The $25 bonus is available only for new accounts with a new Customer as primary owner. Bonus starts earning interest (Variable rate of 0.75% APY effective 3/21/2014) upon account opening, but is unavailable for withdrawal for 30 days.

The $25 bonus is available only for new accounts with a new Customer as primary owner. Payout immediately, but cannot be withdrawn until after 30 days.

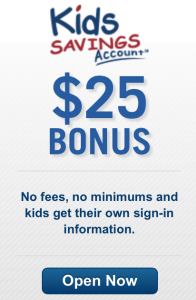

$25 Incentive for Kids Banking

Kids Savings Account: The $25 bonus is available for new accounts adding at least one new Customer to the bank. Bonus starts earning interest (Variable rate of 0.75% APY effective 3/21/2014) upon account opening, but is unavailable for withdrawal for 30 days.

The $25 bonus is available only for new Kids accounts with a new Customer as primary owner. Payout immediately, but cannot be withdrawn until after 30 days.

This is a great way to help kids learn about money and saving. It is also a way they can learn financial responsibility as well.

$25 Incentive for Teens Banking

MONEY: Bonuses are available for new accounts adding at least one new Customer to the bank. To be eligible for the bonus, open MONEY and make 1 Card purchase within 30 days of account opening. Pay out of the $25 for this account takes place on day 35. Variable 0.25% APY effective 3/21/2014.

The $25 bonus is available only for new Teen accounts with a new Customer as primary owner. Payout on day 35, please not that the interest for this account is less than the adult and kids accounts.

This is a great way to help teens learn how to become fiscally responsible with the they earn or are given.

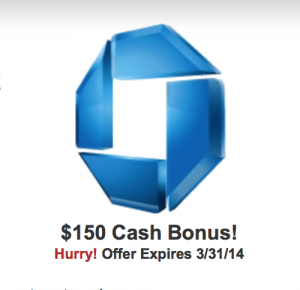

$150 Bank Incentives

With a Chase Total CheckingSM account* you can set up a direct deposit and get a $150 cash bonus.

This is a limited time offer that will expire: March 31, 2014. Sign Up for a Chase Checking Account Here.

To receive the bonus:

- Open a new Chase Total CheckingSM account, which is subject to approval;

- Deposit $100 or more within 10 business days of account opening; AND

- Have your direct deposit made to this account within 60 days of account opening. Your direct deposit needs to be an electronic deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the government.

Pay out is within 10 business days, after you have completed all the above requirements. The bonus cannot be used as the opening deposit. You can only receive 1 new checking account-related bonus per calendar year. Bonus is considered interest and will be reported on IRS Form 1099-INT.

Account Closing: If your checking account is closed within six months, we will deduct the bonus amount at closing.

**Be careful with this deal because if you do not comply to 1 of the 3 scenarios below, you could be charged a service fee.

Choose one of the 3 options below to avoid being charged a $12 Monthly Service Fee for the Chase Total CheckingSM account. ($10 Monthly Service Fee for CA, OR and WA)

- Have monthly direct deposits totaling $500 or more made to this account; OR,

- The daily balance in your checking account should remain at or above $1,500; OR,

- Keep an average daily balance of $5,000 or more in any combination of qualifying Chase checking, savings and other balances.

Remember, when depositing your money in any bank. Always read the fine print and consult your financial advisor to decide whether or not this deal is right for you and your family. Always be aware of cancellation fees and the minimum requirements to take advantage of the bank incentives offered.

[highlight] *Affiliate links enclosed. Read Cleverly Changing’s full disclosure policy here. [/highlight]