Finance Friday time makes me excited. Right now, it’s tax season. Have you already itemized all of your deductions, received your taxes, or are waiting to receive a tax refund? If you can nod yes to any of those questions then you should listen keenly; especially, if you’re among those lucky enough to receive a refund.

Hopefully, you haven’t spent the money already (even if only in your mind) because there are options that can help you increase or make the most out of your refund. Today, I’m sharing five positive tax return actions that may come in handy.

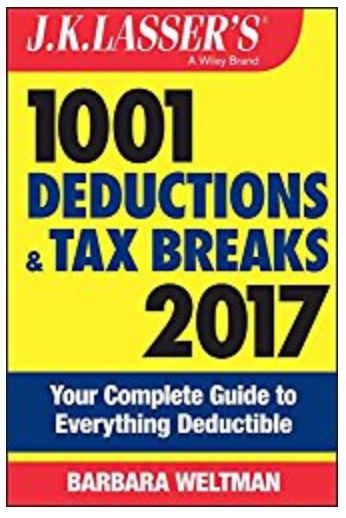

Before completing your taxes decide which itemized deductions fit best or if the standard deduction that you qualify for is the most fiscally responsible option. For those you own a small business, I highly recommend that you find a good CPA to help you make the best choices for your bank account. The book below is also a great gem to have on hand:

Ideally, read the book at the beginning of the year so throughout the year you can compile your receipts and information correctly. Every year the items that can be deducted change slightly.

Take these positive tax return action steps regarding your tax refund

1st Positive Tax Return Action is Set a budget

Most people have bills to pay, so the first order of business would be to decide who will get paid first. Find out which debts or bills have the highest interest rates and pay those accounts down first.

I really like how simple Dave Ramsey‘s Money Cash Flow plan is and it’s free to download on his site: Monthly Cash Flow Plan

Second Positive Tax Return Action is Pay Down Debt

Growing up, many people would use their tax refund check to buy a new wardrobe or finance a car. Rarely, if ever, did they pay down debts. One single mom is making headlines because she paid her rent for a year with the tax refund she received. While, it’s commendable she is thinking ahead, investing her money would probably increase her funds; while on the other hand, paying her rent in advance only provided her with peace of mind. If you have high interest credit card debt. Pay that before you make any purchases.

The Third Positive Tax Return Action is Fund your Emergency Savings

Some people seem allergic to the thought of having money sitting in their account unused. Just because you have access to the money doesn’t mean spending it is a good option. Exhibit self-discipline and allow the money to sit in the bank until a real emergency arises. By the way needing a Louboutin is not an emergency. In fact, I’ve wanted a really nice expensive purse for years; although, I can purchase one, I don’t believe in investing in clothes and accessories, but instead, I’d rather spend money on houses and stocks.

The Fourth Positive Tax Return Action is Invest in Order to Grow

After the budget is complete and debt is paid, look for ways to invest your money to help grow your cash. One way that is simple, yet satisfying is using the money to invest in your retirement. Retirement may not be an attractive word to you now, but paying money into it now can be a breath of fresh-air later. For many people traditional and Roth IRAs also provide tax deductible benefits for your federal and state taxes. Putting the money aside today can help your quality of life in years to come.

The Last Positive Tax Return Action is Invest in wealth building for the next generation

Most parents don’t want to only provide for their kids while they are alive; instead many want to have something to give their children later on after they are passed on. Wouldn’t it be great if more children were able to benefit financially from the choices their parents made on their behalf? Yes, it would be great to leave them with wealth and assets so they can have money to rely on and continue to pass it on to the next generation. Therefore, my last and one of the most important options is to invest in a good life insurance plan with your tax return. This simple decision can make a huge difference.

Tune in every Friday at 12:30 EST on Facebook to join my live “Finance Friday” discussion. I hope to see you there!